Logo

August Majtenyi

Lifecycle Investing

Objective: Impliment Lifecycle Investing in my Financial Planning

Context: For an explanation of Lifecycle Investing I recommend reading the book or my one-page overview.

Using Leverage Responsibly

For early-stage investers, the book recommends deep in-the-money, two-year calls for leverage.

It also argues that 2:1 leverage is best for consistency and risk of ruin planning.

This Options Calculator has the implied leverage, interest, and value relative to Black Scholes.

The following numbers are an actual LEAP that I purchased in my ROTH on June 22, 2023.

From Book to Broker

The online broker I use offers a tool for analyzing profit/losses from calls. The images show how this example call estimates profit with a combination of leverge (2.01) and loan interest (8.08%)

One way to interpret the 8.08% interest is that the underlying stock price needs to increase by at least this much over two years for the call to be profitable. This happens 78% of the time over the last 40 years of S&P 500 Stock data.

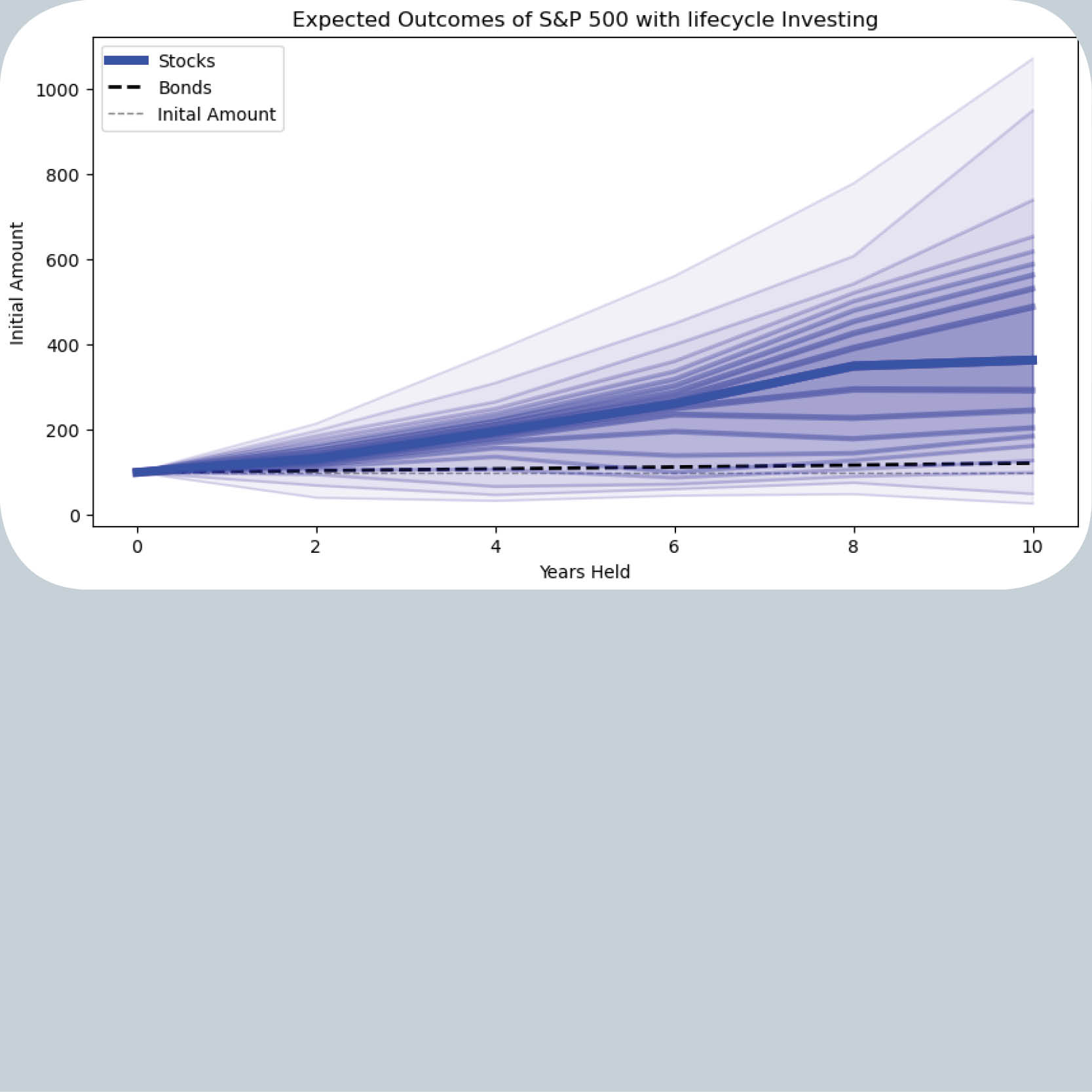

Simulating this strategy over 10 years

The thickest blue line is the 40-year historical median, and the other lines represent 5% quantiles.

The median outcome outperforms passive investing by 55 percentage points over 10 years.

Continuing the Strategy for Future Years

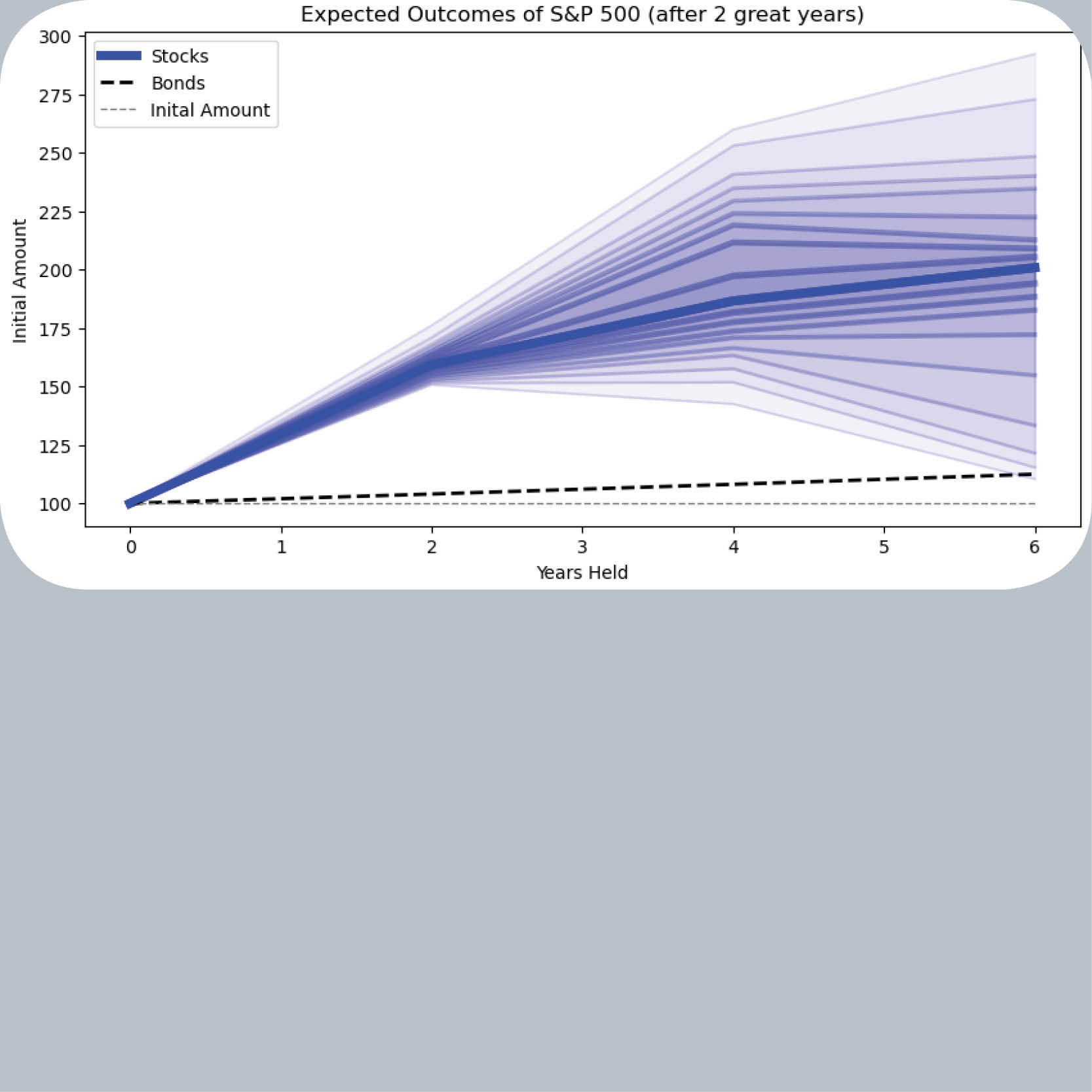

Implimenting this strategy in the middle of 2023 has so far been very profitable.

With the stock market performing as well as it has, should I quit while I am ahead?

Is the market due for a correction after 60% growth in two years?

Over the last 40 years, the S&P 500 has grown 50%+ over two years only 12% of the time. Based on historical data, these LEAPS are still 68% likely to be profitable for the two years that follow.

Conclusion

I am lifecycle investing, but the real battle is sticking to this strategy after a large market drop. When this eventually does occur, I will need to stick to the plan and not waiver based on my subjective experience.

If you have questions on my simulations, or how volatility plays a role, or my risk of ruin plan,

I encourage you to contact me to learn more.